C & F FINANCIAL (CFFI)·Q4 2025 Earnings Summary

C&F Financial Posts Record Year with 38% EPS Growth as Diversified Model Delivers

January 27, 2026 · by Fintool AI Agent

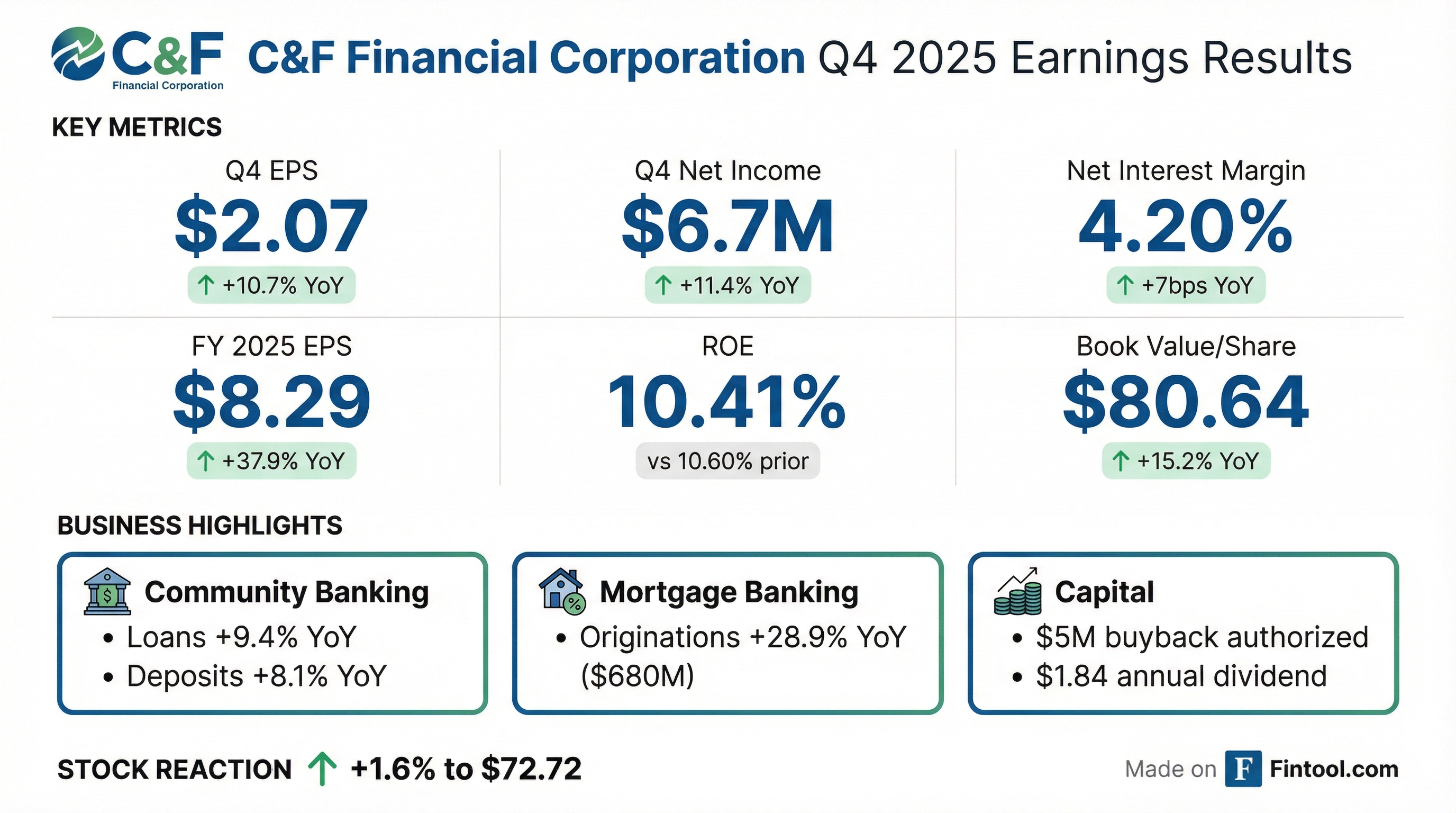

C&F Financial Corporation (NASDAQ: CFFI) reported Q4 2025 earnings of $2.07 per share, up 10.7% from $1.87 a year ago, capping a record year where full-year EPS surged 37.9% to $8.29 . The Virginia-based regional bank holding company demonstrated the strength of its diversified business model, with community banking, mortgage banking, and consumer finance segments all contributing to the year-over-year improvement.

CEO Tom Cherry emphasized the company's execution: "Our diversified business model remains our greatest strength and is a primary catalyst for the increase in earnings in 2025" .

Did C&F Financial Beat Earnings?

Limited analyst coverage makes beat/miss analysis unavailable. As a small-cap regional bank (~$235M market cap), CFFI has minimal sell-side coverage. However, the year-over-year comparisons show substantial improvement:

For full-year 2025, the performance was even stronger:

How Did the Stock React?

CFFI shares rose +1.6% on the earnings announcement, closing at $72.72 on January 27, 2026. The stock trades at a modest valuation relative to book value:

The stock has traded relatively flat over the past year (-3.6% 1-year return) but is up 2.9% YTD in 2026. The price-to-tangible book of 1.0x is at parity, suggesting the market values the franchise at approximately the value of its tangible equity.

What Changed From Last Quarter?

Several notable shifts emerged in Q4 2025:

Net Interest Margin Compression Stabilized: After peaking at 4.24% in Q3 2025, NIM contracted slightly to 4.20% in Q4 2025 but remained above prior year levels. Management noted higher interest-earning asset yields offset lower deposit costs .

Mortgage Banking Surged: Loan originations jumped 42.6% YoY to $186.0M in Q4, driven by both purchase ($149.0M) and refinancing activity ($37.0M) . A decrease in market interest rates drove increased refinancings sequentially.

Consumer Finance Softening: The segment wound down its marine/recreational vehicle loan program during Q3 2025 after the third-party administrator significantly decreased sales. This portfolio will run off over the next several years .

Southwest Virginia Expansion: The community banking segment added a seasoned lending team in Southwest Virginia during Q3 2025, which contributed to higher salaries and employee benefits but positions the bank for growth .

Segment Performance

C&F operates three distinct business segments. Here's how each performed:

Community Banking

The segment benefited from higher interest income on loans and securities, loan growth in commercial real estate and equity lines, and a net reversal of provision for credit losses ($50K for full year vs $1.7M provision in 2024) .

Mortgage Banking

Despite sustained elevated mortgage rates and low inventory, originations surged. The Lender Solutions division also grew mortgage lender services fee income by servicing more third-party mortgage lenders .

Consumer Finance

Delinquencies rose to 4.38% from 3.90% a year ago, but net charge-offs improved. The segment is reducing overhead costs and exiting the marine/RV program .

Credit Quality Remains Strong

Asset quality at the community banking segment remains excellent:

The slight increase in nonaccrual loans was due to one residential mortgage relationship downgraded in Q1 2025 . A commercial real estate loan that had a specific reserve was resolved in Q2 2025, contributing to the provision reversal .

Capital and Shareholder Returns

C&F maintains strong capital ratios well above regulatory minimums:

Dividends: The company declared $1.84 per share in dividends during 2025, representing a 22.2% payout ratio. The Q4 2025 dividend was $0.46 per share, paid January 1, 2026 .

Buybacks: The Board authorized a new $5.0 million share repurchase program for 2026. No shares were repurchased under the 2025 program .

Liquidity Position

C&F maintains robust liquidity with total available funding exceeding uninsured deposits:

Liquid assets (cash, deposits at other banks, nonpledged securities) totaled $537.1M at December 31, 2025 . Uninsured deposits net of intercompany and secured municipal deposits were $527.8M (22.5% of total deposits), well covered by available liquidity .

Management Commentary

CEO Tom Cherry highlighted the drivers of success:

"Growth in loans and deposits at the community banking segment, wealth advisory revenue at the community banking segment, loan originations at the mortgage banking segment, and efforts to enhance operational efficiencies at the consumer finance segment all combined to drive higher performance."

He also emphasized the strategic positioning:

"We remain deeply committed to a strategic plan focused on leveraging our strengths and capturing opportunities that drive above-market results."

Forward Catalysts

Near-term:

- Impact of new Southwest Virginia lending team on community banking growth

- Mortgage market sensitivity to interest rate movements

- Marine/RV portfolio runoff at consumer finance segment

Capital allocation:

- $5.0M share repurchase authorization for 2026

- Dividend sustainability with 22% payout ratio

Risks:

- Consumer finance delinquencies trending higher (4.38% vs 3.90%)

- Elevated interest rates impacting mortgage volumes

- Potential increase in provision if loan performance deteriorates

Key Takeaways

- Record year: Full-year 2025 EPS of $8.29 represents 38% growth, driven by diversified business model

- NIM expansion: Net interest margin expanded 9bps YoY to 4.21% for the full year

- Mortgage strength: Originations grew 29% YoY despite elevated rates and low inventory

- Credit discipline: Community banking net charge-offs at just 0.01% of average loans

- Capital deployment: New $5M buyback authorized; stock trades at 1.0x tangible book

This analysis was generated by Fintool AI Agent based on C&F Financial Corporation's Form 8-K filed January 27, 2026.

Related Links: